Buyer’s credit is a short-term loan or credit facility extended by an overseas lender (usually a bank or financial institution) to an importer (buyer) for financing their purchase of goods or services.

✅ The importer (Indian company) uses buyer’s credit to pay the exporter (supplier).

✅ The overseas lender makes payment directly to the exporter on behalf of the importer.

✅ The importer repays the lender at the end of the credit period — typically 6 months to 1 year, and up to 3 years for capital goods.

💡 How Buyer’s Credit Helps in Fundraising

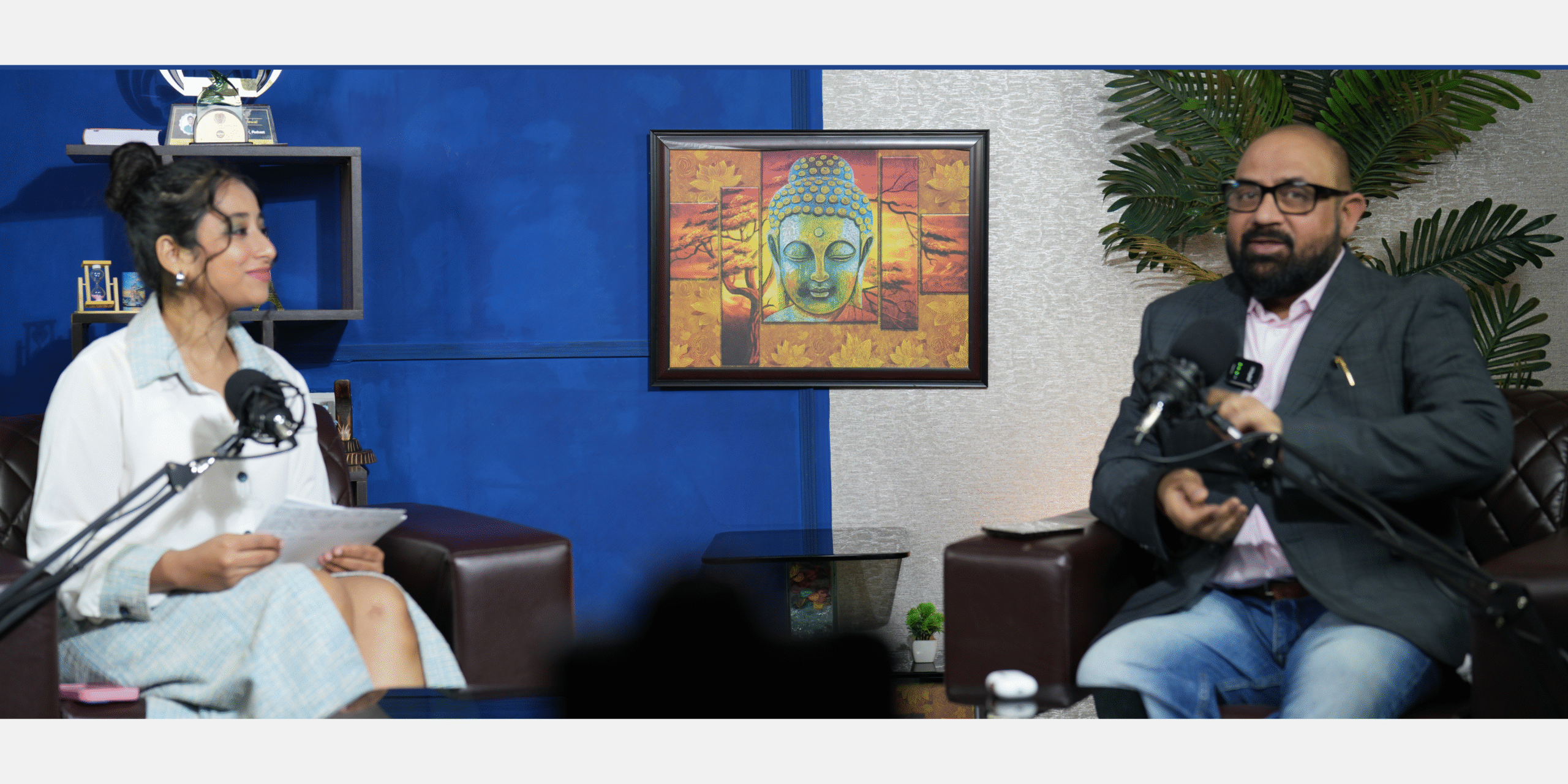

Though traditionally used for imports, smart companies leverage buyer’s credit as a liquidity tool and fundraising strategy. As highlighted by Rajesh Shukla, Chief Strategist, it is one of the most practical tools for liquidity management in India.

✅ 1️⃣ Deferred Cash Outflow

No need to pay the exporter upfront from own funds.

Payment is deferred for 6–12 months (sometimes more).

This acts as short-term funding at a low cost, often cheaper than local working capital.

✅ 2️⃣ Arbitrage of Lower Interest Rates

Buyer’s credit is usually priced at LIBOR/SOFR + small spread.

This is significantly cheaper than most domestic borrowing rates.

Freed-up working capital can be redeployed into operations, debt servicing, or expansion.

✅ 3️⃣ Raising Funds Against Buyer’s Credit

Indirect fundraising: Import payments are funded through buyer’s credit, while working capital can be used elsewhere.

LC/SBLC backed funding: Many overseas lenders require an LC (Letter of Credit) or SBLC (Standby Letter of Credit) from an Indian bank — these can themselves be discounted to raise cash.

Supplier’s credit route: Even local supplier payments can be structured through offshore arms, creating additional access to cheaper funding.

🛠️ Steps to Raise Funds Using Buyer’s Credit

Step Action Result

1️⃣ Identify imports eligible for buyer’s credit (capital goods, raw materials, etc.) Sets the stage for external funding

2️⃣ Apply through an Indian bank with overseas tie-up Access to foreign lender credit line

3️⃣ Bank issues LC / SBLC as security Enhances credibility for funding

4️⃣ Overseas lender funds exporter Cash outflow is deferred

5️⃣ Company redeploys working capital for business needs Improved liquidity, stronger growth

⚖️ Regulatory Points to Note (India Specific)

RBI guidelines: Tenure capped at 1 year for raw materials; up to 3 years for capital goods.

ECB compliance: All buyer’s credit transactions fall under External Commercial Borrowing (ECB) reporting framework.

Forex hedging: Since buyer’s credit is in foreign currency, hedging is strongly recommended to mitigate risk.

📊 Example Use Case — Fundraising via Buyer’s Credit

🔹 A company imports machinery worth USD 10 million.

🔹 Instead of paying upfront, arranges buyer’s credit at SOFR + 200 bps (6% p.a.).

🔹 Repayment due after 1 year → frees up ₹80 crore equivalent in working capital today.

🔹 That ₹80 crore can be used to:

✅ Pay overdue creditors

✅ Restart production

✅ Service overdue loans (help in RFA revival)

🎯 Summary

➡ Buyer’s credit = low-cost foreign funding + liquidity enhancer

➡ Works best when structured smartly with LCs/SBLCs for lender confidence

➡ A powerful tool for RFA revival and corporate fundraising, as it allows companies to restart operations and regain financial stability

✨ As explained by Rajesh Shukla, buyer’s credit isn’t just a trade finance tool — it’s a strategic lever for fundraising, liquidity management, and business revival.

👉 For more insights on fundraising, credit strategies, and business revival, visit rajeshshukla.com

Watche Now : How Sugar Factories Can Raise Debt & Equity? A Must Watch Video.