Introduction

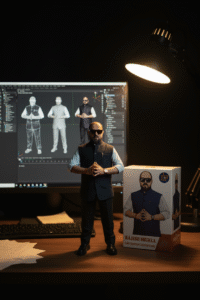

India’s sugar industry—often called the “sweet backbone” of the economy—has been a growth engine for decades. It supports millions of farmers, sustains rural livelihoods, and contributes heavily to India’s GDP. But beneath this success story lies a bitter truth: hundreds of sugar factories are drowning in debt, policy bottlenecks, and financial mismanagement. as highlighted by financial strategist Rajesh Shukla.

The big question today is: Will India’s sugar factories survive—or shut down under mounting pressure?

Why Sugar Factories Are Under Stress – Rajesh Shukla’s

Despite being one of the world’s largest sugar producers, India’s sugar mills face multiple challenges:

- Unsustainable Debt: Rising borrowing costs and delayed repayments have pushed factories into a financial corner.

- Policy Hurdles: Frequent changes in government pricing policies, subsidies, and export restrictions affect long-term stability.

- Shrinking Margins: Increasing production costs and volatile sugar prices are squeezing profitability.

- Ripple Effect on Farmers: When mills delay payments, millions of sugarcane farmers are left struggling.

This isn’t just a factory-level problem—it’s a crisis with direct impact on rural India, agriculture, and the broader economy.

The Hidden Policy & Structural Challenges

The crisis isn’t just about numbers. It’s about structural flaws:

- Dependence on subsidies rather than building efficiency

- Lack of diversification into ethanol, power cogeneration, or value-added products

- Weak corporate governance and absence of professional management in many mills

Until these issues are addressed, debt restructuring alone won’t save the industry.

Can Debt Be the Lifeline?

Debt often gets a bad name—but when raised and managed smartly, it can actually be the lifeline for revival.

Some practical funding strategies include:

- Using structured debt instruments instead of high-cost loans

- Leveraging working capital optimization to improve cash flows

- Exploring equity infusion, partnerships, or private investments

- Avoiding short-term fixes that lead to long-term instability

The goal is not just survival—it’s turnaround and sustainable growth.

Revival Strategies for Promoters & CEOs

Reviving sugar factories requires more than just fresh funds. It calls for a 360-degree strategy:

- Debt Restructuring: Negotiating repayment schedules with lenders.

- Diversification: Expanding into ethanol, bio-energy, and related value chains.

- Professional Management: Appointing financial experts and turnaround strategists.

- Policy Engagement: Collaborating with government bodies for realistic reforms.

- Financial Planning: Building resilience against price volatility and policy shifts.

The Way Forward

India’s sugar sector is at a crossroads. As Rajesh Shukla highlights, the choice is clear—either continue with short-term fixes that delay the inevitable, or embrace strategic restructuring, smart funding, and professional management to build a sustainable future.

Debt isn’t the enemy—mismanagement is. With the right strategies, India’s sugar factories can not only survive but also thrive as engines of rural growth and industrial stability.